Highlighting an obvious issue, shipbroker Gibson attempts to shed light on how will the latest round of sanctions on Russian oil trade, be implemented? In its latest weekly report, shipbroker Gibson said that “with just over 5 weeks to go until the European Union’s ban on Russian crude oil imports come into effect, companies are now being forced to decide which market they wish to trade in. Simultaneously, the G7 oil price cap is also due to enter into force and although the price cap is yet to be finalized and requires EU ratification, the EU’s crude oil embargo looks set in stone. So, the question now turns to who will continue to buy Russian crude post December 5th, and how logistically are they going to transport that crude”.

According to Gibson, “if the price cap fails to materialize, EU shipping companies might be allowed to continue transporting Russian crude to third countries, as has been the case with Russian coal exports following clarification after the EU’s August embargo. Nevertheless, price cap or not, the volumes of Russian crude which can be legitimately transported without falling fowl of EU, US, or UK sanctions (if G7 services are used) is expected to be below today’s volumes. Shipping companies will therefore have to choose their side. The balance of tonnage in both the Russian and non-Russian trading fleets will be critical for the strength of the mainstream crude markets. Ahead of December 5th, it is expected that many companies trading with Russia will pull back to ensure all Russian cargoes on board have been discharged by the deadline and migrate back into non-Russian trade”.

“Our analysis shows that in the last 6 months, 366 Afra/LR2 and Suezmax tankers have been observed loading in Russian ports (excluding CPC), with more than 55% of those vessels controlled from EU, G7 or allied countries. Of those 366 vessels, 37 have been involved in ownership changes this year, with further analysis of their current ownership suggesting they will largely remain in Russian trade. However, with over 200 vessels leaving Russian trade, it is reasonable to assume that there might be insufficient tonnage to transport Russian oil to market, particularly given that those barrels currently traded to Europe will have to be redirected longer haul”, the shipbroker noted.

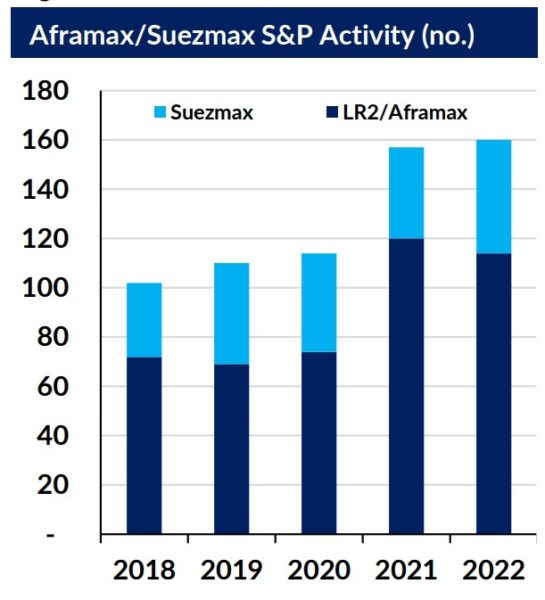

Gibson added that “so far this year, Gibson counts around 160 Aframax/LR2 and Suezmax S&P transactions. Of those, around 2/3rds have gone to buyers which could be willing to transport Russian crude post sanctions implementation. However, it is important to consider that vessels currently engaged in Iranian or Venezuelan trade could migrate, which has been seen on a limited scale already, and VLCCs could be used in transshipment operations, with over 40 VLCCs sold this year to Asian or Middle Eastern buyers. Some sales will have also gone under the radar, whilst other vessels from non G7/EU countries could be attracted into Russian business if freight premiums rise”.

“Of course, the Russian trading fleet could remain undersupplied, which would drive increased S&P activity and potentially support secondhand values higher. It is also important to note that the Russian fleet might not trade efficiently. Evidence of Iranian and Venezuelan trading patterns teach us that sanctioned barrels often go through multiple transshipments before reaching their final destination. Such practices are inefficient, meaning more vessels are required for the same volume of non-sanctioned cargoes. In any case, some transshipment activity will be necessary this winter, with ice class tonnage needing to be kept locally during peak ice conditions”, said the shipbroker.

“In the short term, there is a risk that as vessels migrate out of Russian trade, non-sanctioned trade routes will see increased vessel supply, putting downwards pressure on rates. However, this will be partially offset but increases in tonne mile demand, meaning that earnings are expected to remain comfortably above historical averages. Furthermore, increased S&P activity will likely readdress the balance as we move into 2023”, Gibson concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide